Wayfair: Sales Tax and State Income Tax Implications

TaxConnex

MARCH 18, 2021

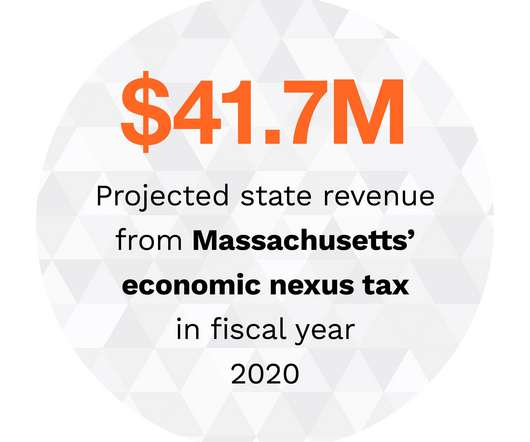

Supreme Court decision in South Dakota v. Wayfair created enormous changes for businesses making remote sales into the states related to sales tax. Could Wayfair have also impacted the way you manage your state income tax obligations? Sales Tax Perspective. Sales Tax Implications of Wayfair.

Let's personalize your content