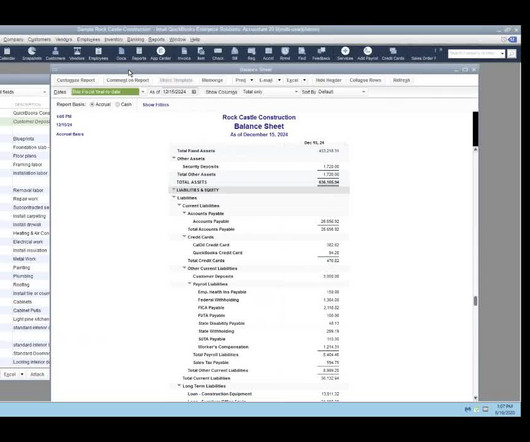

How to Account for Bad Debts and Record it in Quickbooks Online and Desktop

Ronika Khanna CPA,CA

JUNE 23, 2023

Your customer has become non responsive despite efforts to contact them and you feel that it is not longer worth trying to collect There are ways to mitigate the possibility and impact of bad debts. In accounting parlance there would be a credit to sales and a debit to accounts receivable. You will be prompted to create a new item.

Let's personalize your content