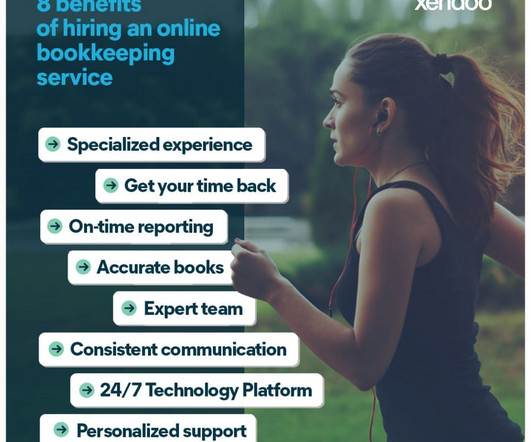

How To Find The Right Online Accountant For Your Business

xendoo

SEPTEMBER 10, 2021

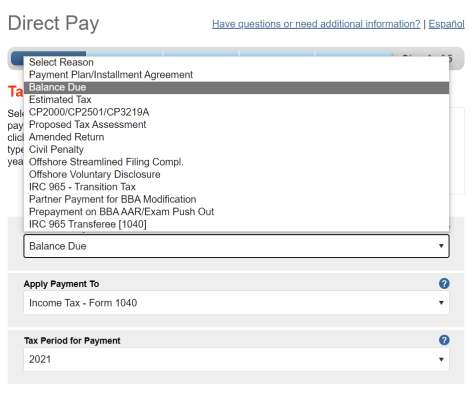

A small business accountant can provide guidance at every stage of your company’s development, and they can be invaluable when it comes to tax preparation, succession planning, and more. An online accountant can also deliver these services at a price that fits the limited budget of modern business owners. . Tax planning.

Let's personalize your content