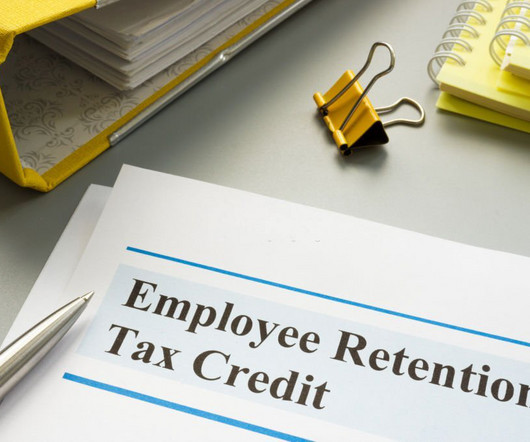

IRS Outlines Withdrawal Process for Employee Retention Tax Credit (ERTC) Claims

RogerRossmeisl

NOVEMBER 20, 2023

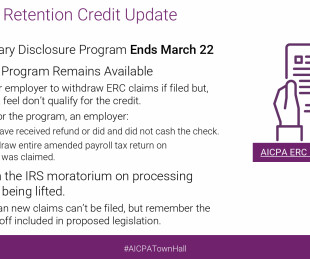

The post IRS Outlines Withdrawal Process for Employee Retention Tax Credit (ERTC) Claims appeared first on Roger Rossmeisl, CPA. This new withdrawal option allows certain employers that filed an ERTC claim but have not yet received a refund to withdraw their submission and avoid future repayment, interest and penalties.

Let's personalize your content