HMRC loses £47m as 100,000 accounts hit in phishing fraud

Accounting Web

JUNE 5, 2025

HMRC has lost £47m to a “sophisticated” fraud after cybercriminals used stolen personal data to access or create tens of thousands of online tax accounts.

Accounting Web

JUNE 5, 2025

HMRC has lost £47m to a “sophisticated” fraud after cybercriminals used stolen personal data to access or create tens of thousands of online tax accounts.

Accounting Today

JUNE 4, 2025

The Internal Revenue Service's new Data Book shares a host of positive results from last year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

JUNE 2, 2025

Oh no, not this again ! This story is making the rounds today and it’s highly relevant to the audience not just because AI is being shoved down everyone’s throats including accountants’ You’ll see why in a minute. First, the quick story of what’s happening with Builder.ai: The Natasha neural network turned out to be 700 Indian programmers The startup BuilderAI offered to write any application, like in a constructor, by selecting the necessary functions.

CPA Practice

JUNE 4, 2025

The Atlanta-based top 30 firm said June 4 it has acquired Nextfed, an Arlington, VA-based strategy consulting and M&A advisory firm with experience in the commercial aerospace, defense, and government services sectors.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

SkagitCountyTaxServices

JUNE 4, 2025

Payroll day has a way of sneaking up on you. Even when things are running smoothly, theres still that moment of holding your breath Will the software cooperate? Are the numbers right? Is everyone getting paid on time? And if something does go wrong, its on you to stop and figure it out. Fast. If youre using QuickBooks Desktop 2022, you need to know (if you dont already): Intuit officially pulled the plug on it this weekend.

SchoolofBookkeeping

JUNE 4, 2025

When it comes to automating payments in QuickBooks, it’s easy to get swept up in the promise of “set it and forget it.” But as any experienced accountant or bookkeeper knows, the devil is in the details. Let’s objectively break down recurring invoices, recurring payments , and autopay—what they do, where they shine, what to watch for, and what you’ll pay in fees. 1.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

JUNE 4, 2025

The Treasury Inspector General for Tax Administration's latest report to Congress includes successes and failures at the IRS.

CPA Practice

JUNE 6, 2025

Search for: Home About Us Log In Subscribe for Free My Account Log Out Accounting & Auditing Accounting ESG Financial Reporting Nonprofit Small Business Auditing Audit Standards PCAOB SEC Tax Taxes Income Tax IRS Legislation Sales Tax State Local Taxes Tax Planning Payroll Payroll Benefits Human Resources Payroll Software Payroll Taxes Tech Technology Artificial Intelligence Automation Cloud Technology Digital Currency Hardware Security Software Advisory Advisory CAS Financial Planning Risk

AccountingDepartment

JUNE 4, 2025

At AccountingDepartment.com, we know that exceptional client service isnt just about clean booksits about empowering our people to do their best work and grow professionally. Thats why our Accounting Manager role is such a critical part of our team structure. This leadership position bridges the gap between our Senior Accountants and Controllers, ensuring that both clients and team members receive the high-level support they need.

Withum

JUNE 2, 2025

As NetSuite users continue to explore and integrate artificial intelligence (AI) into their enterprise resource planning (ERP) systems, understanding how to effectively communicate with AI becomes crucial. One key skill in this evolving space is prompt engineering. As NetSuite continues to roll out more AI application updates, its a good time for users to explore prompt engineering in NetSuite and how it can be leveraged in AI applications for NetSuite users.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Xero

JUNE 6, 2025

The 2025 Financial Year is almost at an end, so there has never been a better time to prepare. A great first step on your EOFY preparation journey is to review your payroll finalisation. Getting a head start on your organisation’s payroll ensures your July is as easy as possible. Not sure where to start? You’ve come to the right place. Whether this is your first payroll finalisation, or your hundredth, blast past your tax time stress by following our handy list of steps. 1.

Accounting Today

JUNE 5, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

CPA Practice

JUNE 3, 2025

A 2024 AFP survey found that 91% of US businesses still use checks, up from 75% the year before.

Accounting Insight

JUNE 6, 2025

Technology-embracing firms enjoy nearly two-thirds more revenue growth compared to their competitors, according to a recent report on the future of accounting. With MTD for Income Tax, the UK government’s initiative to digitalise the tax system—approaching its next significant phase, this stark contrast serves as both an urgent signal and a compelling invitation to accounting professionals across Britain.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

ThomsonReuters

JUNE 4, 2025

Highlights: Pillar Two introduces unprecedented complexity, requiring sophisticated technology software. Orbitax Global Minimum Tax (Orbitax GMT) automates data collection and validation, reducing manual entry errors while ensuring regulatory compliance. Early technology adoption, staff training, and continuous monitoring of regulatory changes are essential for successful Pillar Two implementation.

Insightful Accountant

JUNE 6, 2025

Skip to main content Search Learn More About Our Premium Content | Subscribe To Our Newsletters facebook twitter youtube linkedin instagram RSS Accounting Platforms General Ledger Payroll & Merchant Services Vendor Corner APPS Directory Top ProAdvisor Awards Top ProAdvisor Awards People & Business Practice Management APP Academy Tax Practice News Webinars/Events In Person Events Free Webinars Webinar Archives Podcasts Premium Content Home Podcasts How WISS Is Transforming Accounting with

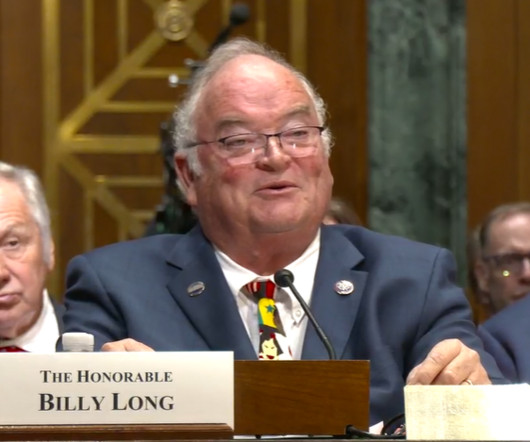

Accounting Today

JUNE 2, 2025

Billy Long's confirmation process to take the helm of the Internal Revenue Service is well underway, running alongside mass layoffs and other regulatory moves.

CPA Practice

JUNE 4, 2025

Smarsh Capture provides compliance teams with enhanced tools to securely govern Microsoft 365 Copilot and significantly enhance productivity.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

CapataCPA

JUNE 5, 2025

2025 Tax Reform – “The One Big Beautiful Bill” Simplified As part of a sweeping new proposal making its way through Congress, the “One Big Beautiful Bill” outlines a series of tax changes that could significantly impact both individuals and business owners beginning in Tax Year 2025. At CAPATA, we’ve summarized the key provisions and how they differ from current tax law so you can stay ahead of what’s coming.

Shay CPA

JUNE 4, 2025

If youre a tech founder in a city like New York, theres a good chance youve come across a quasi-governmental entity known as an Economic Development Corporation (EDC). The New York City Economic Development Corporation (NYCEDC) is one of the most prominent examples, but youll find similar organizations in cities across the globe. Their mandate is straightforward: stimulate local economic growth by attracting businesses, supporting entrepreneurs, and developing strategic infrastructure projects.

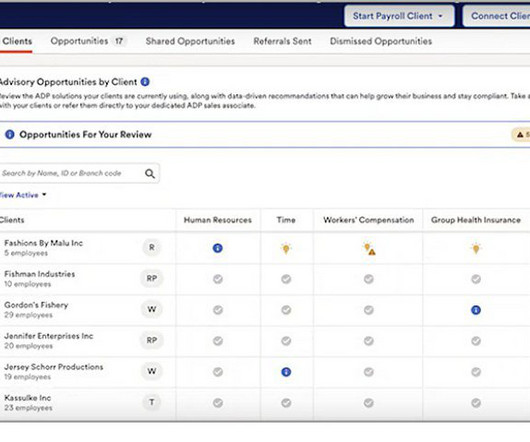

Insightful Accountant

JUNE 9, 2025

ADP®, a leading global technology company providing human capital management (HCM) solutions, has announced the launch of the Accountant Connect Resource Center, a centralized destination designed to help accounting professionals.

Accounting Today

JUNE 6, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CPA Practice

JUNE 4, 2025

Accountants previously using Paychexs AccountantHQ (AHQ) can now seamlessly access the broad range of functionality of Paychex Flex through an intuitive dashboard with simplified workflows.

Accounting Insight

JUNE 6, 2025

Study of oldest invoices show Government departments owed at least £290K but owe at least £1.7 million UK government departments have been waiting on payment for nearly two decades, despite strict regulations designed to ensure timely payments, new Freedom of Information (FOI) data obtained by Quadient (Euronext Paris: QDT), reveals. The oldest outstanding invoice traces back to March 2006, while the government itself is still to pay invoices from as far back as June 2007 – in both cases pre-dat

Dent Moses

JUNE 4, 2025

A C corporation is a legal structure for a business that is taxed separately from its owners. This structure offers significant legal protections and is favored by companies planning to reinvest profits or eventually go public. Unlike S corporations or LLCs, a C corp pays corporate income tax on its profits. If dividends are paid, shareholders are typically taxed on them at qualified dividend rates, creating the possibility of double taxation.

Insightful Accountant

JUNE 4, 2025

Sage, a leader in accounting, payroll and HR software for small and mid-sized businesses, today announced its vision for artificial intelligence at its flagship event, Sage Future.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Today

JUNE 5, 2025

The IRS has released the vast majority of the code used to develop its Direct File program, theoretically allowing anyone to build their own versions.

CPA Practice

JUNE 6, 2025

These newly launched reports aim to help firm owners drive profitability, allocate resources effectively, and make better-informed business decisions.

Going Concern

JUNE 9, 2025

Hey, people. Got some news for you. First, a Reuters story : Crete Professionals Alliance, an accounting platform backed by Thrive Capital, plans to invest over $500 million to acquire U.S.-based accounting firms in the next two years, and equip them with OpenAI-powered artificial intelligence technology to boost efficiency, company executives told Reuters.

Dent Moses

JUNE 9, 2025

On May 22 , the House Republicans passed the One Big Beautiful Bill Act (H.R. 1, also known as the “Bill”). While the Senate committees give their input and changes, time allows us to analyze which expiring Tax Cuts and Jobs Act (TCJA) provisions are extended in the House’s bill and which elements from President Trump’s campaign platform are relevant.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Let's personalize your content