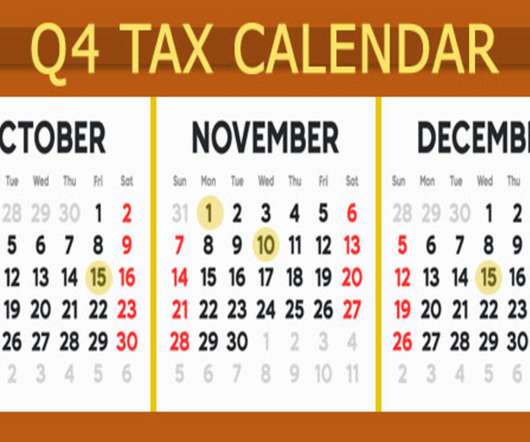

Key Q4 2021 Tax Deadlines for Businesses

RogerRossmeisl

OCTOBER 6, 2021

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2021. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have a business in federally declared disaster areas.

Let's personalize your content