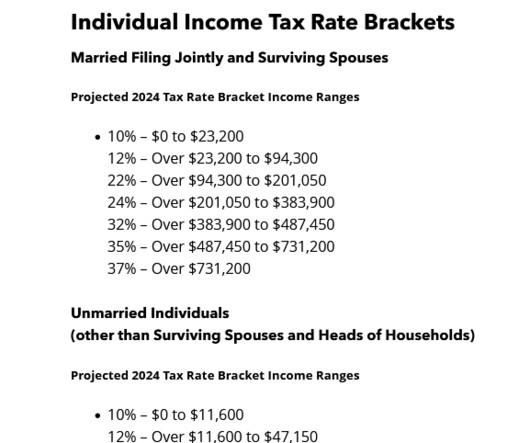

2024 Tax Pocket Guide

Withum

FEBRUARY 20, 2024

The goal of minimizing tax liability likely drives a desire to discover new advantages in the tax law. If this sounds familiar to you, when planning for the upcoming tax year, a great place to start is with the basics. Let’s Chat The post 2024 Tax Pocket Guide appeared first on Withum. We can help.

Let's personalize your content