IRS Plans to Go Paperless by 2025 Tax Season

CPA Practice

AUGUST 2, 2023

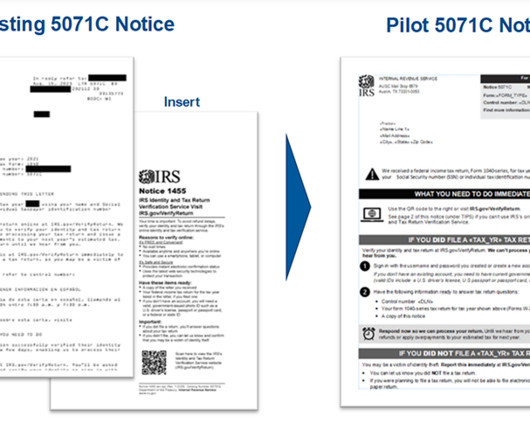

Treasury Secretary Janet Yellen announced on Wednesday that the IRS has set a goal to go paperless by 2025. Today, we are announcing that, by the next filing season, taxpayers will be able to digitally submit all correspondence, non-tax forms, and notice responses to the IRS.” That has generated about $38 million in recoveries.

Let's personalize your content