Casualty Loss Tax Deductions May Help Disaster Victims in Certain Cases

RogerRossmeisl

NOVEMBER 9, 2023

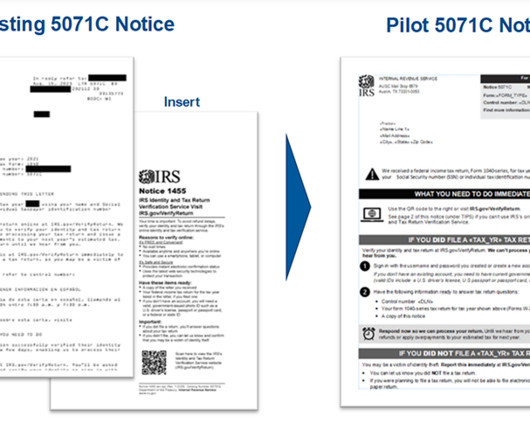

Before the Tax Cuts and Jobs Act (TCJA), eligible casualty loss victims could claim a deduction on their tax returns. What’s considered a casualty for tax purposes? Note: The post Casualty Loss Tax Deductions May Help Disaster Victims in Certain Cases appeared first on Roger Rossmeisl, CPA.

Let's personalize your content