Traveling for Business This Summer? Here’s What You Can Deduct

RogerRossmeisl

JULY 16, 2023

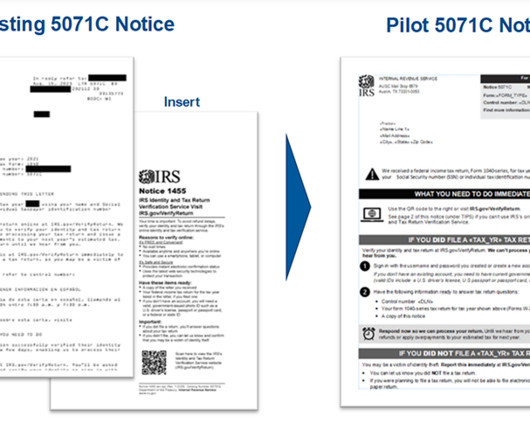

Note: Under the Tax Cuts and Jobs Act, employees can’t deduct their unreimbursed travel expenses on their own tax returns through 2025. That’s because unreimbursed employee business expenses are “miscellaneous itemized deductions” that aren’t deductible through 2025. The post Traveling for Business This Summer?

Let's personalize your content