Tax Debt Relief: What You Need to Know When You Owe the IRS

MyIRSRelief

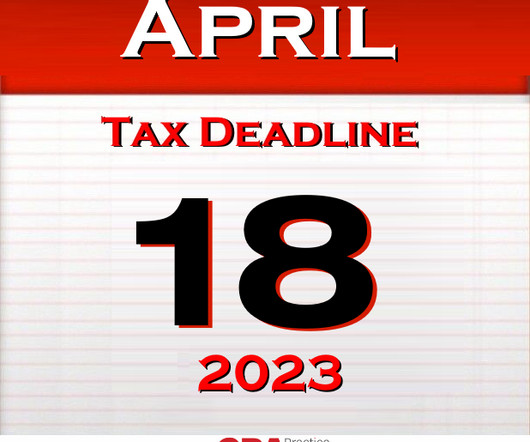

APRIL 12, 2024

However, there are several avenues for tax relief available to those who owe the IRS. This comprehensive guide will explore the options for obtaining tax relief, aiming to provide clarity and hope to those grappling with tax debt concerns. While in CNC status, the IRS temporarily halts collection activities.

Let's personalize your content