Mastering Tax Planning: Proven Strategies to Minimize Your Tax Liabilities

MyIRSRelief

JULY 17, 2023

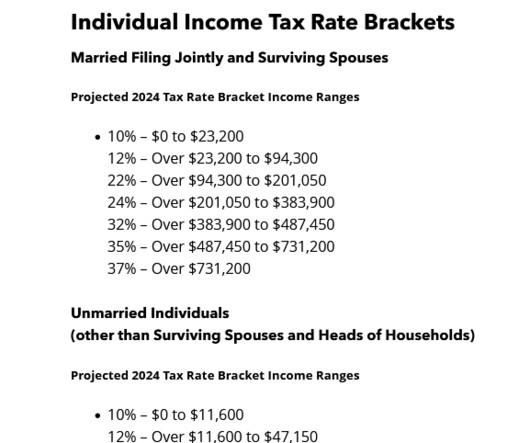

Tax planning is a vital aspect of financial management, both for individuals and businesses. It involves a proactive approach to legally reduce tax liabilities by optimizing financial decisions throughout the year. Section 1: The Importance of Tax Planning 1.1. Section 2: Tax Planning for Individuals 2.1.

Let's personalize your content