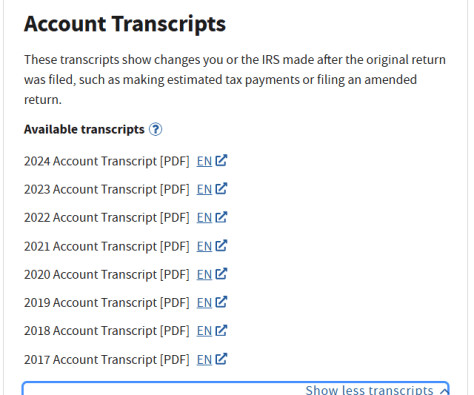

IRS Expands Business Tax Accounts to Include S Corporations and Partnerships

CPA Practice

DECEMBER 18, 2023

The Internal Revenue Service has launched the second phase of a new online self-service tool for businesses that expands business tax account capabilities and eligible entity types. This next step in the evolution of the Business Tax Account will help these businesses download transcripts and other features.

Let's personalize your content