PKF O’Connor Davies Adds Rainer & Co. in Pennsylvania

CPA Practice

JUNE 2, 2025

The top 30 accounting firm said on June 2 it has acquired Rainer & Co., a regional CPA firm with offices in Newtown Square and West Chester in Pennsylvania.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CPA Practice

JUNE 2, 2025

The top 30 accounting firm said on June 2 it has acquired Rainer & Co., a regional CPA firm with offices in Newtown Square and West Chester in Pennsylvania.

Accounting Today

JUNE 6, 2025

XcelLabs provides solutions to help accountants use artificial technology fluently and strategically. The Pennsylvania Institute of CPAs and CPA Crossings joined with Padar and Tolin as strategic partners and investors. "To All rights reserved. These offerings are currently in beta testing.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

TaxConnex

DECEMBER 12, 2024

Even though the marketplace youre selling through collects and remits the sales tax on their platform, these sales need to be accounted for to determine whether youve reached economic nexus thresholds. (We generally recommend that companies start paying attention to a states economic nexus laws when they hit $100,000 in that state annually.)

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Accounting Today

JUNE 6, 2025

EDT 3 Min Read Facebook Twitter LinkedIn Email The accountant the world urgently needs has evolved far beyond the traditional role we recognized just a few years ago. Yet, in many areas, accounting education stubbornly clings to outdated, overly technical models that fail to connect with the actual demands of the market.

Accounting Today

APRIL 25, 2024

Firms must transform their business models to afford the cost of multilayered retention strategies, a new report by the Pennsylvania Institute of CPAs says.

CPA Practice

APRIL 26, 2023

The Pennsylvania Institute of Certified Public Accountants , the largest CPA association in Pennsylvania with over 20,000 members, has issued its latest Insights report. The report’s deep dive provides the latest data on compensation across titles, technology adoption, billing model breakdowns, M&A and more.

TaxConnex

DECEMBER 3, 2024

The company was then referred by its tax advisors to an outside accountant who specialized in sales taxes, and the company applied for and was granted voluntary disclosure agreements to pay back taxes. Pennsylvania has released additional sales tax guidance on software, digital goods and related services. Nevada , starting Jan.

TaxConnex

DECEMBER 17, 2024

Technology products/services can also be complex, especially if tech companies claim they provide professional services, a term states often limit to such fields as engineering, medical, law and accounting. Several of the biggest facilitators might store your goods in a warehouse in a state that no one in your company has ever set foot in.

TaxConnex

MARCH 2, 2021

Pennsylvania is offering a 90-day Voluntary Compliance Program for any business that has inventory or stores property in the state but isn ’ t registered to collect and pay Pennsylvania taxes. Sales tax accounts for 59% of the state’s tax collections. Texas sales tax collections totaled $3.07 billion in January 2021 , 0.3%

CPA Practice

APRIL 9, 2024

As accountants and CPAs, dealing with payroll taxes is essential to managing finances for your business clients. As an accountant or CPA, you play a vital role in: Calculating and withholding taxes correctly. Your client will be assigned an employer tax account number for the state. By Nellie Akalp.

TaxConnex

AUGUST 18, 2022

Now, other tax developments may serve as the model for eventual physical sales tax nexus created by remote employees: For income tax purposes, residency can be based on where someone works, maintains bank accounts, maintains a driver’s license or votes, as well as by numerous other details of connection with a state or jurisdiction.

Going Concern

JULY 25, 2022

Some headlines to get you started on this fine Monday: KPMG partner banned from accounting after misleading regulator over Carillion. The spread of ESG labels into the $55 trillion market for short-term debt is creating new accounting challenges for those keeping track of how much good green finance is actually doing. KPMG fined £14.4

CPA Practice

FEBRUARY 19, 2025

Holladay, UT-based Platform has entered Pennsylvania for the first time after adding Orwigsburg-based Keystone Advisor Group, formerly known as Heckman & Laudeman.

CPA Practice

NOVEMBER 29, 2023

Founded in 1897, the Pennsylvania Institute of Certified Public Accountants (PICPA) is the second-oldest CPA organization in the U.S. They are also evaluating how they currently engage young people across the state, and are looking to engage students as early as freshmen in high school to drive their interest in accounting careers.

CPA Practice

NOVEMBER 15, 2024

Brown Plus Welcomes New Team Members Leading accounting and advisory firm,Brown Plus, recently announced the addition of four new team members to its office in Camp Hill, Pennsylvania: Devin Brown, CPA, MBA, rejoins Brown Plus as an Audit Senior Manager. We’re excited to welcome Devin back to Brown Plus! In the U.S.,

CPA Practice

APRIL 16, 2024

The Philadelphia Inquirer (via TNS) Molly Kowal decided to become an accountant in part because she knew it would be a stable career. My generation is more focused on maintaining that work-life balance,” said Kowal, who works at accounting firm EisnerAmper in Philadelphia. “A By Lizzy McLellan Ravitch.

CPA Practice

SEPTEMBER 13, 2024

The Tennessee Society of CPAs (TSCPA) is pleased to award $280,000 in scholarships through the TSCPA Educational & Memorial Foundation to 128 Tennessee accounting students. Together, Life Associates have helped approximately 4,000 students over the last 25 years pursue a degree in accounting and sit for the CPA Exam.

CPA Practice

JANUARY 17, 2023

PICPA also announced a coming legislative update scheduled for March of 2023 that will cover Pennsylvania Gov. Nevada: The Nevada Society of Certified Public Accountants (NVCPA) announced several upcoming events including the 2023 Annual Gaming Conference , which is scheduled to take place May 16 and 17, 2023.

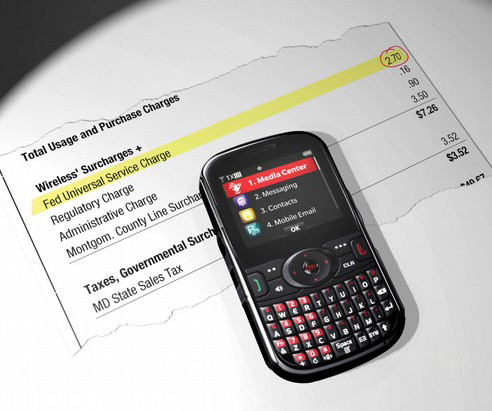

TaxConnex

AUGUST 11, 2022

Pennsylvania: The Department of Revenue continues to warn about sales tax scam letters to business owners claiming to be from the state. The letters include the Department of Revenue’s name and logo and say recipients are under investigation for failing to pay Pennsylvania taxes. Ecommerce and sales tax cybercrime is on the rise.

Accounting Today

AUGUST 14, 2024

The CPA certification is the third-most valued credential for CFO roles, according to a report by the Pennsylvania Institute of CPAs.

Going Concern

JUNE 26, 2024

We’re not talking about the high number of people who are sticking around at their firms right now because the market is so screwy but rather this is about respondents to a Pennsylvania Institute of CPAs survey they’ve called “ CPA Talent Retention 2024: Keeping Your Best Performers.”

CPA Practice

MAY 11, 2023

In a recent study, Tipalti found which states were the best to pursue a career in finance or accounting by analyzing the number of jobs available, average salaries, and university rankings. Here’s which states ranked best for a career in finance or accounting. They also determined the best-paying jobs for finance graduates.

TaxConnex

JANUARY 27, 2022

year over year – later even predicting a big decline to account for “the shock” from pandemic lockdowns. Arkansas, Kansas, Pennsylvania, Tennessee, Texas and Florida were the latest states to report sales tax revenue shattering predictions. When retailers pivoted to online operations, though, 2020 e-sales grew 3.4%. Long term, U.S.

CPA Practice

MAY 18, 2023

Victoria Saravia Bazoberry (New York), a graduate of the University of Notre Dame with a Bachelor of Business Administration in accountancy, is employed with KPMG LLP in New York, NY. Sells, one of the first CPAs in the U.S., was active in the establishment of the AICPA and played a key role in advancing education within the profession.

CPA Practice

JANUARY 29, 2025

Pittsburgh-area accounting and financial advisory services firm Marsico Financial has acquired Care Accounting, a firm based in Beaver Falls, PA.

CPA Practice

FEBRUARY 7, 2023

The Hawaii Society of Certified Public Accountants is offering a webinar on February 17, 2023 titled Schedules K-2 and K-3: Why Even Partnerships and S Corporations with No Foreign Activities or Members May Need to Prepare These Forms. The Minnesota CPA and the MNCPA CPAPAC are offering CPA Day at the Capitol.

TaxConnex

FEBRUARY 15, 2024

Use of Amazon’s FBA program may also create physical nexus in Washington, part of the stored-inventory question that has moved forward in many states (though not, notably, in Pennsylvania ). Pennsylvania’s Department of Revenue has released a bulletin regarding the sourcing of sales other than services and tangible personal property.

CPA Practice

AUGUST 6, 2024

Brown Plus Welcomes Four New Team Members Leading accounting and advisory firm,Brown Plus, recently announced the hiring of four new team members: Michael Corona started with Brown Plus as an intern and is now an Audit Associate. He graduated from York College with a Bachelor’s degree in Accounting. Sikich Announces 2024 James A.

Accounting Today

SEPTEMBER 30, 2022

(..)

Accounting Today

DECEMBER 16, 2024

Pennsylvania Institute of CPAs CEO Jennifer Cryder dives into why and how new paths to CPA licensure are opening up.

TaxConnex

JULY 12, 2022

Pennsylvania is changing how taxpayers e-file sales and use and excise returns, make payments and renew licenses, among other services. Sales tax is the largest source of state funding for the state budget, accounting for 59% of all tax collections. The changes become effective Jan. 1 next year. compared to the same period a year ago.

CPA Practice

JUNE 1, 2023

AICPA & CIMA Now Offers New Learning Tools for Accounting Professionals The AICPA & CIMA recently announced the offering of anew online learning platform to help accounting and finance professionals improve and update their skills to take advantage of a digital accelerating business environment.

Going Concern

MARCH 7, 2023

A 55-year-old Philadelphia woman is being charged with ethnic intimidation and harassment — a hate crime under Pennsylvania law — after an unhinged, racist rant in a pizza shop brought on by Spanish language programming on the shop’s television. I’m not giving my money to some illegal immigrant. You’re in America.

Going Concern

MAY 20, 2024

PwC is facing legal action claiming the accountancy firm is liable for the alleged rape of a graduate employee following after-work drinks. Shout-out to NPR for continuing to stay on top of the accounting shortage. Illinois CPA Society has issued a new pipeline report: Re-Decoding the Decline. Find it, and other ICPAS insights, here.

Accounting Today

JUNE 6, 2025

ARIZONA The Association for Accounting Marketing Hall of Fame celebrated the 35th anniversary of the annual AAM Summit in Phoenix May 12-14. CALIFORNIA Janet Shepard Janet Shepard was hired as a business management partner and co-leader of the client accounting services practice at HCVT, Irvine. All rights reserved.

CTP

FEBRUARY 29, 2024

So, as an accountant of a gambling client, you need to have detailed knowledge about gambling winnings and losses, as well as all the rules and regulations related to tax on gambling income. As an accountant, you must analyze your client type, their category, and how much their gambling income will be considered as taxable income.

PANALITIX

SEPTEMBER 30, 2020

IN Accounting Businesses. Panalitix CEO Mark Ferris recently presented a webinar on Building a Sales Culture in accounting businesses. From a Stockholm-based firm: What about accountants without a “selling personality”… How do we help them sell and enjoy sales? . RESOURCES / ARTICLES. Building a Sales Culture. compliance).

CPA Practice

JULY 10, 2024

Schneider Downs is a Top 60 independent Certified Public Accounting (CPA) firm providing accounting, tax, audit, and consulting services to public and private companies, not-for-profit organizations and global companies. The firm also offers risk advisory, wealth management, personal financial services and retirement plan solutions.

TaxConnex

DECEMBER 13, 2022

billion in sales online, up 4% over last year and accounting for 16.7% Sales tax rules change all the time: Pennsylvania, for instance, just ruled on nexus for sellers with inventory in an Amazon warehouse. On Cyber Monday 2021, $10.7 billion was recorded in sales, a drop from 2020’s $10.8 trillion in the U.S. trillion last year.

MyIRSRelief

MAY 24, 2023

When to Seek Help from a Certified Public Accountant A certified public accountant (CPA) is a licensed professional who has met certain education, experience, and examination requirements. CPAs are qualified to provide a wide range of accounting, tax, and consulting services. Contact us for professional tax help today.

CPA Practice

SEPTEMBER 12, 2024

Earlier in his career, Burke held several progressive managerial roles in financial services, including serving as executive vice president and chief lending officer at Wayne Bank, where he managed the overall sales, service, and operations of the commercial banking division across Pennsylvania and New York. Hollerich holds a B.A.

TaxConnex

JANUARY 26, 2023

Gary Bingel, partner-in-charge for state and local taxes in accounting firm EisnerAmper’s State and Local Tax National Tax Group, made several predictions for 2023 in sales and other taxes. There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent changes and updates. Crystal ball time.

Going Concern

SEPTEMBER 4, 2024

The retiree plan clients are: Central Pennsylvania Teamsters Knoll, Inc. CBIZ has filed a data breach notification with the attorney general of Maine and you know what that means. Wait, maybe you don’t know what that means. Liberty Utilities Sanofi Sanofi Pasteur Seven Maine residents were affected by this breach.

Going Concern

NOVEMBER 4, 2022

Mr. Kaiden is a certified public accountant and holds a B.A. in Professional Accounting from the University of Hartford and an M.B.A. from The Wharton School of Business at the University of Pennsylvania. Kaiden is a certified public accountant and holds a B.A. in Political Science from Hamilton College, an M.S.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content