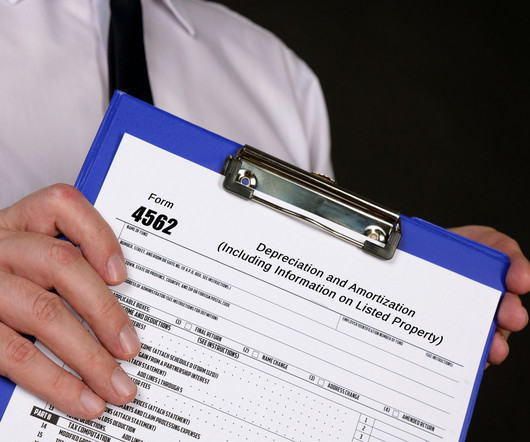

Los Angeles accountant for small business – Mike Habib, EA

MyIRSRelief

APRIL 3, 2023

That’s where an accountant (EA or CPA) can help. A Los Angeles, CA accountant can provide essential financial expertise and support to small business owners, helping them make informed decisions and manage their finances efficiently. Contact us today for all you tax and accounting needs.

Let's personalize your content