Financial vs Tax Accounting

SMBAccountant

MARCH 8, 2023

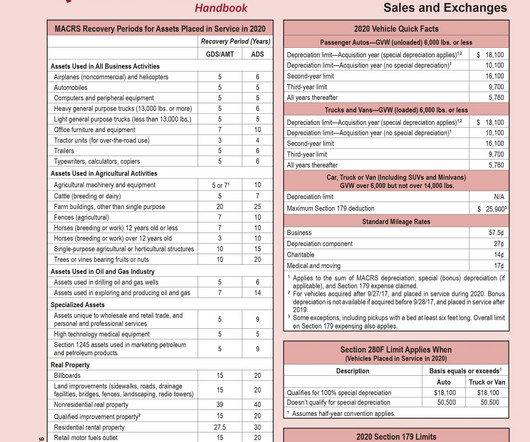

One type of accounting that is well-known is tax accounting. According to Investopedia, tax accounting is “a structure of accounting methods focused on taxes rather than the appearance of public financial statements”. Tax accounting applies to individuals, businesses, and corporations.

Let's personalize your content