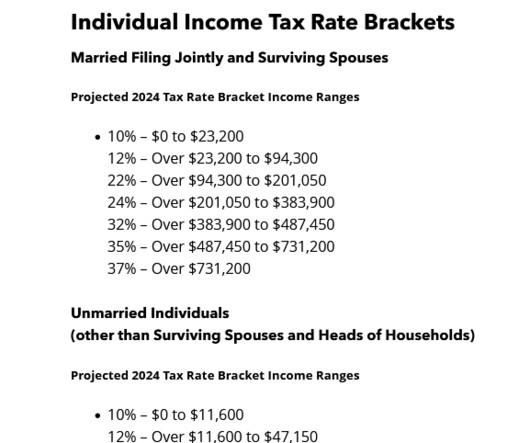

Projected 2024 Income Tax Brackets

CPA Practice

SEPTEMBER 14, 2023

Bloomberg Tax & Accounting released its 2024 Projected U.S. Tax Rates, which indicates inflation adjusted amounts in the tax code will increase 5.4% See projected tax bracket tables below.] The report accounts for changes made under the Inflation Reduction Act and the SECURE 2.0

Let's personalize your content