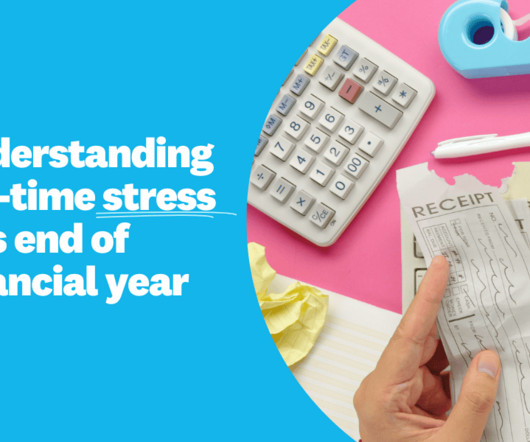

4 things tax and audit professionals to know about agentic AI

ThomsonReuters

DECEMBER 10, 2024

Predictive AI Predictive AI, which many firms already use, focuses on analyzing historical data to make forecasts and inform decisions. These tools excel at identifying patterns and trends, helping tax professionals anticipate future outcomes based on past performance. Read full press release 3. How is agentic AI different from RPA?

Let's personalize your content