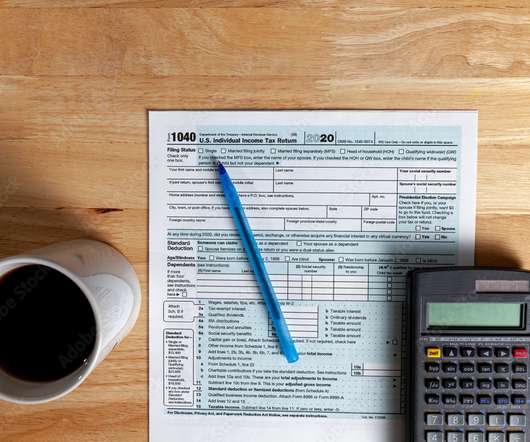

The Current State of Managing Sales Tax Obligations

TaxConnex

FEBRUARY 13, 2024

Their responses are included in the following blog. This doesn’t have to be through automation, even with AI being the buzzword it is in the last few years, automation typically comes top of mind. More than 100 financial leaders from different industries and from a wide range of sizes responded. Get in touch to learn more!

Let's personalize your content