When do I have to start collecting out of state sales tax? Part 1

TaxConnex

JULY 19, 2022

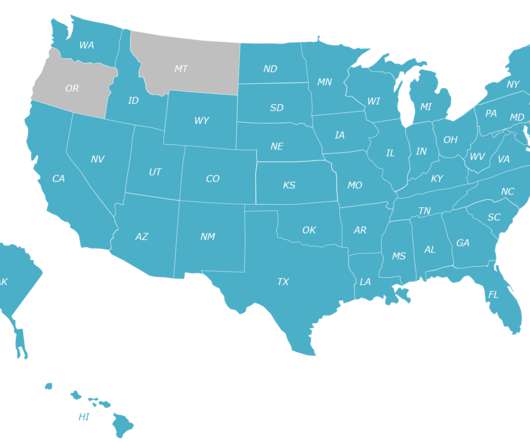

Sales tax obligations are among them. It’s been four years since these obligations began landing on businesses’ plates nationwide, and the situation isn’t getting any easier. Only now are federal lawmakers beginning to wonder if the current sales tax landscape overburdens online businesses.

Let's personalize your content