What to know about Form 4562: Depreciation and Amortization

ThomsonReuters

DECEMBER 1, 2023

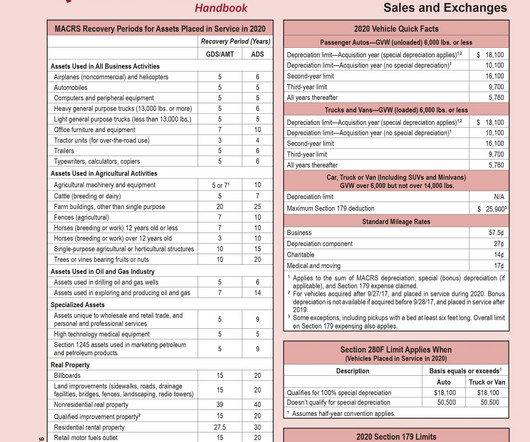

Therefore, helping business clients save money and reduce their tax burden by expensing property they’ve purchased for their company and claiming deductions for depreciation or amortization of assets is critical. Section 179 is an immediate expense deduction that allows taxpayers to deduct a set dollar amount. What is Form 4562?

Let's personalize your content