Understanding depreciation and its impact on corporate tax

ThomsonReuters

AUGUST 25, 2023

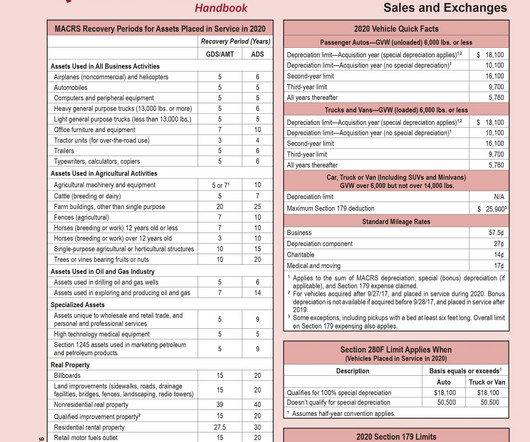

Jump to: How does depreciation affect corporation taxes? Accelerated depreciation for corporations How does depreciation work in an S corporation? What is the purpose of making a provision for depreciation? What is the depreciation guidance for corporate alternative minimum tax? 1, 2023.

Let's personalize your content