So… what is carbon accounting?

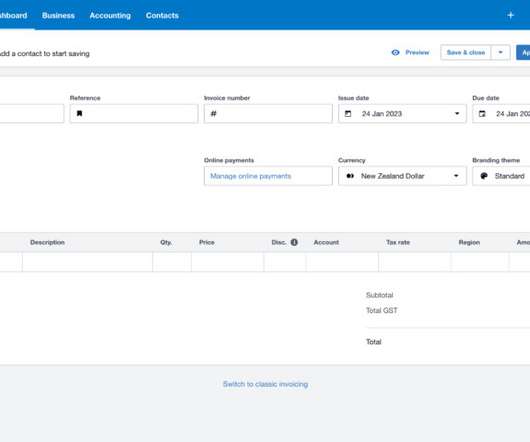

Xero

APRIL 17, 2024

Understanding the environmental impact of your business is critical in today’s business environment — and carbon accounting is a fundamental step in this process. With carbon accounting increasingly becoming another compliance measure mandated by regulators, businesses of all types and sizes need to get their emissions numbers in order.

Let's personalize your content