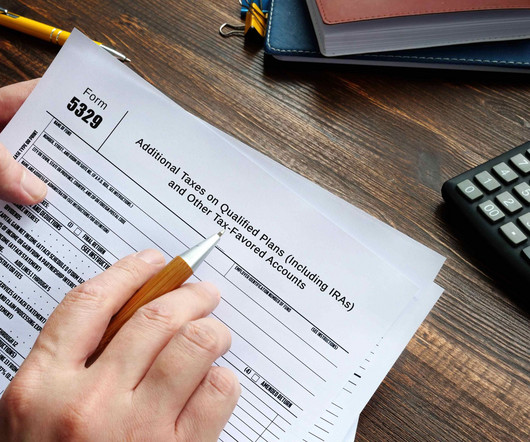

IRS Form 5329: What it is and how to complete it

ThomsonReuters

APRIL 25, 2024

When filing tax returns, it’s important to report all income sources accurately. Let’s look at what this form is all about and how to advise clients who may need to file it. How to stay up to date on retirement tax changes What is Form 5329? Other tax-favored accounts.

Let's personalize your content