Four steps to a seamless payroll year end with Xero Payroll

Xero

MARCH 10, 2024

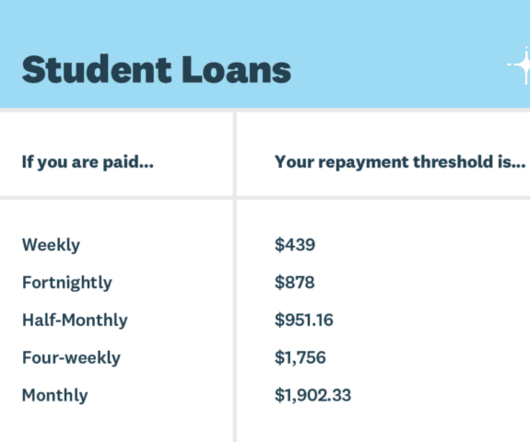

As the summer days become a memory, it signals the onset of a crucial period for payroll professionals in New Zealand. With the approaching new tax year on 1 April 2024, regulatory changes are set to impact payroll calculations across the country. Staying informed and getting prepared is essential. percent to 1.60

Let's personalize your content