Navigating Tax Compliance Challenges in the Trucking Industry: How Our Tax Firm Can Guide You

MyIRSRelief

AUGUST 1, 2023

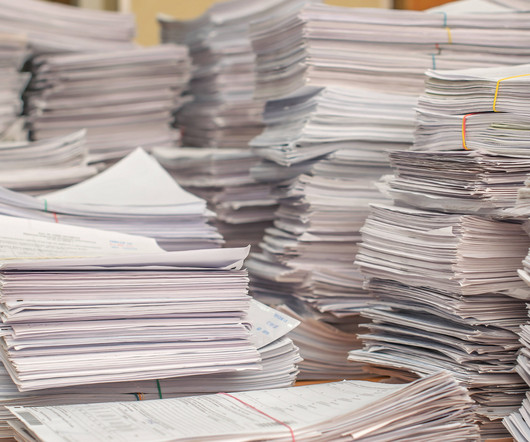

In this blog post, we will explore the common tax compliance challenges faced by trucking companies and highlight how our specialized tax firm can offer tailored solutions to help them overcome these hurdles. However, managing payroll taxes for these two distinct driver categories can be a daunting task for trucking companies.

Let's personalize your content