Automating your way to success: How automation can help relieve accounting staff shortages

ThomsonReuters

NOVEMBER 28, 2023

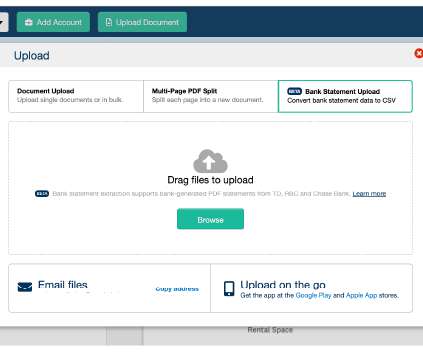

Automation enables your firm to build a work environment that eliminates manual tasks, encourages creativity, supports work-life balance, and is entirely mobile. In 2024, there is no reason that tax professionals should receive paper, sort paper, shuffle paper, or enter data manually. But where do you begin?

Let's personalize your content