Consistent Financial Reporting for Small Businesses

inDinero Accounting

MAY 1, 2024

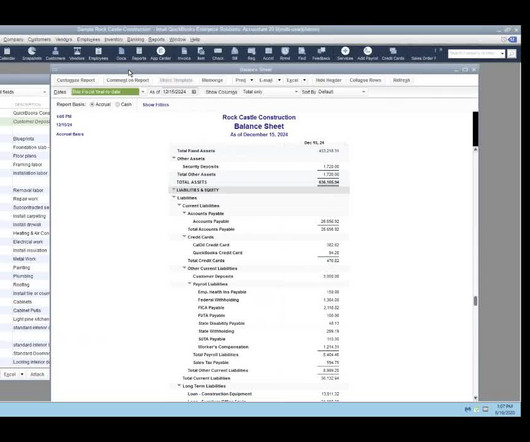

Next is the income statement or the profit and loss statement. This is like a video recording of your business’s revenues, costs, and expenses over a certain period. It tells you whether you’ve earned a profit or suffered a loss during that time. Then, we have the cash flow statement.

Let's personalize your content