New Jersey Business Owner Failed to Pay $10 Million in Payroll Taxes

CPA Practice

AUGUST 17, 2023

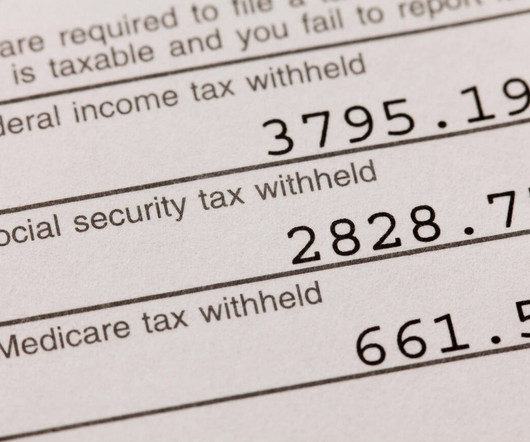

A New Jersey business owner faces a federal prison sentence after failing to pay more than $10 million in payroll taxes. Josef Neuman, 37, of Lakewood, pleaded guilty to willful failure to pay over payroll taxes, the U.S. In all, he defrauded the government of $10,884,373 in payroll taxes in 2017 and 2018.

Let's personalize your content