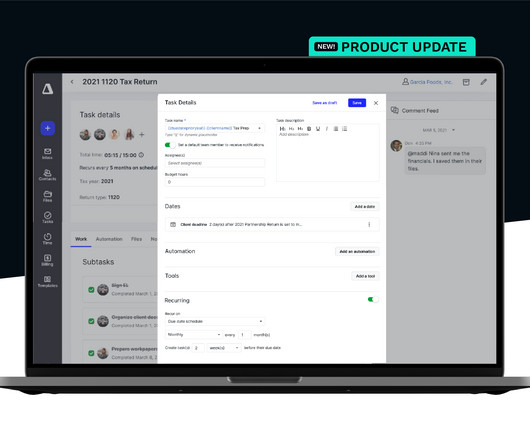

Increase Accuracy and Efficiency with Recurring Task Enhancements

Canopy Accounting

JUNE 7, 2023

What's new: We’ve enhanced the experience of creating and managing recurring tasks within Canopy’s Workflow module to provide more flexibility, context, automation, and accuracy related to work within your firm. These enhancements allow users to create tasks to recur on a schedule based on the tasks due date (not just on completion), automatically create tasks within a specified amount of time before a task due date, and set recurring details on a template.

Let's personalize your content