The productivity problem in accounting

Accounting Today

JULY 20, 2023

Did staff get more or less productive while they were working remotely during the pandemic — and why?

Accounting Today

JULY 20, 2023

Did staff get more or less productive while they were working remotely during the pandemic — and why?

TaxConnex

JULY 20, 2023

Maintaining current, valid exemption certificates is critical in managing your overall sales tax risk. Under audit, an otherwise exempt sale will be deemed taxable without such documentation from a customer – and just a few missing certificates can result in large penalties and interest. Properly documenting exempt sales is a hassle and a pain, but it matters.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 20, 2023

Recently appointed the president of the Information Technology Alliance, Geni Whitehouse wants to be a bridge between small and middle-market businesses.

CPA Practice

JULY 20, 2023

A Top Technology Initiative Article. June 2023. With the spring conference season wrapping up, watching the frenzy around Artificial Intelligence (AI) and its applicability in the profession has been amazing. As noted in my April column , there are various innovative uses of AI and privacy risks for your client data. Recently, Google released its SAIF (Secure AI Framework) regulations based on six principles to enable the creation of high-quality, secure artificial intelligence.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

JULY 20, 2023

Recent data says that companies spent significantly more on software over the past year, with finance departments' spending in particular seeing major spikes.

CPA Practice

JULY 20, 2023

By Laura Weiss, CQ-Roll Call (TNS) House Republicans opposed to limits on deductions for state and local taxes are making their first stand in a move that could test their newfound power in the GOP conference. Their push to force relief from the $10,000 “SALT” cap is shaping up as a major challenge to Republican leadership and underscores the political weight the issue carries in some of the country’s tightest swing districts.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Going Concern

JULY 20, 2023

Have you ever wondered which Big 4 firm has been involved in the most federal litigation in the last four years? No? Well Law Street Media put together this beautiful post about Big 4 firms getting sued in federal court anyway and you’re going to read it. The article is all about analytics so of course it starts with some data: The global networks of Deloitte, EY, KPMG, and PwC made a combined $189.6 billion in revenue in 2022 and employed 1.37 million people.

ThomsonReuters

JULY 20, 2023

As technology continues evolving, the demand for advisory services has grown exponentially. Many firms have found themselves needing to stay up-to-date with the latest trends and technologies in order to remain competitive in the market. In response, Thomson Reuters has created an Advisory Report Quiz as an easy way for CPA advisors to assess where their firm stands in its advisory journey and take actionable steps towards elevating their practice.

Insightful Accountant

JULY 20, 2023

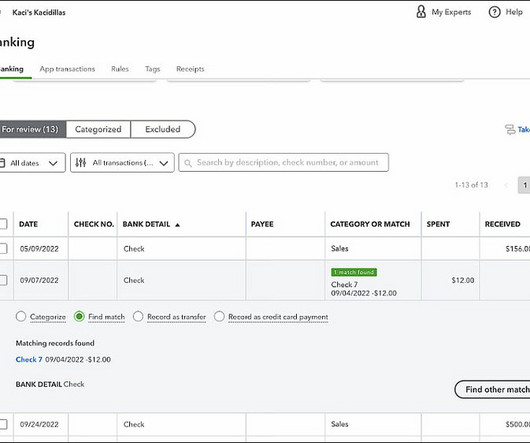

You will save time due to the high-confidence recommended matches using QuickBooks Checks.

SkagitCountyTaxServices

JULY 20, 2023

Raise your hand if you or your workers, in any way, still work remotely post-pandemic. It’s a common enough reality — maybe more so now even than 2020. Working in sweatpants from the comfort of your Skagit County home is infinitely better than dress shoes and uncomfortable desk chairs — and cheaper than paying high business space rent prices. But with so many companies going remote and giving up their brick-and-mortar space, it’s caused a bit of an office space crisis in major cities like NYC (u

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Insightful Accountant

JULY 20, 2023

The accounting profession’s first and only national, independent premier benchmark survey for practicing accounting, tax and bookkeeping professionals will remain open through Sept. 1.

Anders CPA

JULY 20, 2023

Moving from a role in a traditional business to a startup can take some adjustments, but learning how to automate, integrate and build a team from the ground up can empower those who make the switch. On this episode of the But Who’s Counting? podcast, host Dave Hartley sits down with Jane-Ellis Griggs, the VP of Finance and Operations at St. Louis startup turned bestselling sustainable swimwear brand Summersalt.

CPA Practice

JULY 20, 2023

By Roman H. Kepczyk, CPA.CITP. Summertime is vacation season as well as consulting season (my 27 th year on the road) and many of us are heading out on the road with the caveat that we might, yeah maybe, ah yeah. have to work some during a portion of your trip. Guided by the Boy Scout motto of always being prepared, I’m writing this column on my “gotta have items” for working anywhere on the road, along with some personal road warrior tips to minimize summertime travel and work blues.

Accounting Today

JULY 20, 2023

When asking if knowledge in the hands of your clients is helpful … the argument can go both ways.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Cherry Bekaert

JULY 20, 2023

Standard setters have been relatively inactive this year. The Financial Accounting Standards Board (FASB) has issued only two new Accounting Standard Updates (ASUs) and the Government Accounting Standards Board (GASB) has not issued any new GASB Statements in 2023. The latest issue of the Rundown features a summary of the new standards issued 2023. Continue reading to learn more about summaries of the standards issued in the first two quarters and our practice insights.

Accounting Today

JULY 20, 2023

The decision potentially has much broader ramifications than just those with regard to penalties with respect to Form 5471.

Cherry Bekaert

JULY 20, 2023

Section 179D Energy Efficient Commercial Buildings Deduction (Section 179D) was significantly enhanced through the Inflation Reduction Act (IRA), offering commercial building owners and designers, like architects and engineers, potential lucrative tax credits. The tax credit rewards qualifying energy-efficient commercial buildings to encourage clean energy and offset the costs of the improvements.

AccountingDepartment

JULY 20, 2023

Tipalti offers a comprehensive solution for managing global payments, allowing businesses and finance departments to effortlessly automate their payment operations worldwide. This empowers them to adapt to evolving needs while prioritizing crucial initiatives and embracing digital transformation.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

CPA Practice

JULY 20, 2023

Randy Johnston, Chairman Emeritus, Network Management Group, Inc. and Brian Tankersley, President of Adept Practices, Inc., have announced the launch of the 9 th Annual Accounting Firm Operations and Technology (AFOT) Survey. The AFOT Survey will remain open through September 1, 2023. The survey results eBook, to be released in November 2023, will continue to remain a free resource delivered to practicing accounting, tax and bookkeeping professionals who complete the survey.

Cherry Bekaert

JULY 20, 2023

Law firms, like most industries, have seen significant shifts over the past few years, with 2023 possibly its most daunting year yet. Georgetown Law and the Thomson Reuters Institute’s recent report on the 2023 State of the Legal Market 1 indicates falling demand, declining profits and realization, and rising expenses for law firms to be wary of. Legal Industry in Review The report highlights that law firm services fell from 3.7% growth in 2021 to 0.1% growth in the fall of 2022, citing a declin

Insightful Accountant

JULY 20, 2023

NetSuite is empowering customers with embedded learning to help users leverage the power of the suite through training resources aimed at accelerating adoption and enhancing skills.

SchoolofBookkeeping

JULY 20, 2023

In a world where technology continues to reshape the way we work and conduct business, Intuit Inc. has once again taken the lead in simplifying financial management with the launch of its new QuickBooks Workforce mobile app. This innovative app aims to bridge the gap between employers and employees, providing a seamless and integrated solution for tracking work hours, schedules, and payroll – all in one place.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

CPA Practice

JULY 20, 2023

By Erin Bendig, Kiplinger Consumer News Service (TNS) In 2023, Social Security benefits got an 8.7% COLA, the largest cost-of-living adjustment since 1981. According to the United States Social Security Administration (SSA) , “COLAs are based on increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).” So, when inflation starts to cool, that means a lower COLA for Social Security recipients.

Going Concern

JULY 20, 2023

Apparently someone inside EY blabbed to Financial Times about the current state of EY audit quality and the firm “expects more failing grades” from the PCAOB specifically related to work performed offshore for US-listed clients. Their last inspection wasn’t so great , the PCAOB identified deficiencies in twelve of the 56 audits inspected for a deficiency rate of 21.4%–the worst score EY’s gotten since 2018.

CPA Practice

JULY 20, 2023

The Public Company Accounting Oversight Board (PCAOB) on July 19 unveiled six new search filters on its Firm Inspection Reports page to allow investors, audit committee members, and other stakeholders the ability to analyze and compare data from more than 3,700 inspection reports. “PCAOB inspection reports provide investors, audit committees, and potential clients with important information they can use to make informed decisions.

Withum

JULY 20, 2023

Tracking down corporate credit card transactions and reconciling at month-end in an Excel spreadsheet is a thing of the past. When it comes to credit card use and your organization, Sage Intacct has you covered. Sage Intacct defines credit card accounts and includes credit and debit cards. In Accounts Payable, there is a distinct difference between the two.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Cherry Bekaert

JULY 20, 2023

Wayfair v. South Dakota was a landmark case that clarified how sales tax is determined and collected. Brought about by a group of online retailers that challenged a South Dakota law, the case has had major impacts on how state and local jurisdictions throughout the U.S. establish physical presence or nexus. Since the initial ruling of the Supreme Court case, states have begun to set up their own sales tax laws.

Withum

JULY 20, 2023

Here we are; the PPP loan has come and gone. Are you one of the firms dealing with the repercussions of receiving PPP loan forgiveness? Hopefully, you properly accounted for PPP loan forgiveness in preparing your indirect cost rate. Otherwise, you will likely be hearing from your state department of transportation. Per Federal Acquisition Regulation 31.201-5, the applicable portion of any income, rebate, allowance, or other credit relating to any allowable cost and received by or accruing to the

Accounting Today

JULY 20, 2023

The 9th Annual Accounting Firm Operations and Technology Survey will remain open through September 1.

Inform Accounting

JULY 20, 2023

Class 2 NICs are flat-rate contributions payable by the self-employed, currently charged at a rate of £3.45 a week. Non-payment (or credit) could mean entitlement to the state retirement pension (and other contributory state benefits) will be affected unless the individual is also paying Class 1 NIC because they are employed. The majority of self-employed individuals liable to pay Class 2 NIC do so via the self-assessment regime at the same time as paying any income tax due on 31 January after t

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content