IRS employee union relieved after gov't shutdown averted

Accounting Today

OCTOBER 2, 2023

The National Treasury Employees Union expressed a sense of relief after lawmakers in Congress unexpectedly managed to pass a stopgap spending bill.

Accounting Today

OCTOBER 2, 2023

The National Treasury Employees Union expressed a sense of relief after lawmakers in Congress unexpectedly managed to pass a stopgap spending bill.

CPA Practice

OCTOBER 2, 2023

By Dave Charest. Small businesses (SMBs) are a busy bunch. On any given day, they might be fulfilling orders, engaging with customers in-person, managing staff, doing their books — plus dozens of other tasks. Most would relish an opportunity to gain back an extra hour, or save some extra money. Luckily, those goals (and others) are attainable thanks to artificial intelligence (AI) and marketing automation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

MyIRSRelief

OCTOBER 2, 2023

Starting a new business in Los Angeles area is an exciting time, but it can also be overwhelming. There are so many things to think about, from developing a business plan to marketing your products or services. One of the most important things to consider is accounting and bookkeeping. If you’re new to business, you may be wondering why accounting and bookkeeping are so important.

CPA Practice

OCTOBER 2, 2023

The number of job openings and quits in the United States has been on a downward trend for several months, according to data from the Bureau of Labor Statistics. This is good news for employers overall. However, it doesn’t mean CPA firms are finding it any easier to staff available positions — or hold on to the valued employees they already have in place.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Going Concern

OCTOBER 2, 2023

Fun number of the day: 95%. That’s the percentage of hiring managers in finance and accounting having trouble finding skilled talent according to recent Robert Half research. The figures come from a survey of hiring managers and employees from small (20-249 employees), midsize (250-499 employees) and large (500-plus employees) private, publicly listed and public sector organizations.

Accounting Today

OCTOBER 2, 2023

Affected individuals and businesses now have until Feb. 15 next year to file various federal tax returns and make tax payments.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

OCTOBER 2, 2023

Eleven states have created or expanded a fully refundable child tax credit following the expiration at the end of 2021 of the federal measure, which enabled families to get as much as $3,600 per child.

Going Concern

OCTOBER 2, 2023

Hey, welcome to October. You have my permission to start putting up those Halloween decorations now. Let’s get right to it! The news, I mean. Here’s something for anyone who needs it (you know who you are): Back in the office? Here’s how to be professional in the workplace Bloomberg explains the PwC Australia tax scandal’s impact on firm governance in many words, a good read for anyone who still doesn’t understand what’s going on over there and what happened last week wit

Accounting Today

OCTOBER 2, 2023

For accounting firms to scale, they need to build a stronger infrastructure of professional HR, marketing, IT and other support systems, explains Rachel Anevski.

CPA Practice

OCTOBER 2, 2023

As part of a larger effort to improve technology, the Internal Revenue Service has added new features to its Tax Pro Account system that allow tax professionals access to new services to help their clients. New additions to Tax Pro Account, available through IRS.gov, will help practitioners manage their active client authorizations on file with the Centralized Authorization File (CAF) database.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

OCTOBER 2, 2023

While each firm has one managing partner, each partner plays a role in managing part of that practice.

Going Concern

OCTOBER 2, 2023

We didn’t get around to writing up this September 25 news release from CPA Ontario last week, better late than never. Here’s what happened: Ontario public accounting licensing body CPA Ontario reached an out-of-court settlement with Marcum LLP resolving allegations of multiple instances of US Marcum partners performing work in Ontario — including issuer audits — without said partners being licensed to practice in the province.

CPA Practice

OCTOBER 2, 2023

As incidents of retail crime continue to escalate throughout the country, retailers have seen a dramatic jump in financial losses associated with theft. When taken as a percentage of total retail sales in 2022, “retail shrink” accounted for $112.1 billion in losses, up from $93.9 billion* in 2021, according to the 2023 National Retail Security Survey released today by the National Retail Federation. ( *The 2021 figures have been updated to reflect the April 2023 U.S.

Anders CPA

OCTOBER 2, 2023

Daniel K. Schindler, CPA has been named to St. Louis Small Business Monthly’s Best Accountants list. Each month, Small Business Monthly polls readers to help identify the best in the area in a particular industry. The 2023 Small Business Monthly Best Accountants list features 27 local accountants voted the best in St. Louis. About Dan Schindler Dan’s unwavering dedication to his clients has followed him from his first year at the firm as a tax intern through his journey to partner.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CPA Practice

OCTOBER 2, 2023

As of Sept. 1, 2023, interest on federal student loans is accruing again after being waived, along with loan repayments, since the March 2020 onset of the COVID-19 pandemic. Now, individuals with federal student loans must begin planning to start repaying these debts for the first time in more than three years. With this in mind, and with October being National Financial Planning Month, it’s the perfect time to study up on some smart money management tips.

Xero

OCTOBER 2, 2023

We’re excited to be coming to a city near you with the Xero UK Roadshow, bringing you the latest updates in Xero. From fresh features to the latest industry trends, there’s so much on offer to help you run your practice more efficiently so you can do more of the things that really matter. We’ll be visiting six cities between 31 October and 22 November 2023: London: Tuesday 31 October Bristol: Thursday 2 November Birmingham: Tuesday 7 November Belfast: Thursday 9 November Edinburgh:

CPA Practice

OCTOBER 2, 2023

Social media appears to be having a significant influence on consumer spending, as a new Bankrate report reveals that Americans spent $71 billion on impulse purchases of products they saw on a social media platform in the past year, with the average impulse buyer spending $754. [link] Overall, almost half (48%) of social media users say they have made an impulse purchase of a product they saw on a social media platform at some point, and 68% of those who have done so regretted at least one of th

CTP

OCTOBER 2, 2023

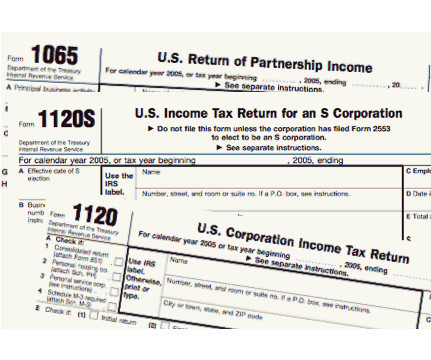

Every year countless taxpayers overlook money-saving opportunities in the form of tax credits. This provides tax professionals with an opportunity to look like magicians as we whip money-saving strategies out of our proverbial hats in the form of readily available credits that our clients may have never heard about. Taxpayers also may be unaware of the rules surrounding tax credits—for instance, that if they learn after the fact they were eligible for a tax credit, they may still be able to clai

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

CPA Practice

OCTOBER 2, 2023

There are a myriad of challenges and changes in the tax codes affecting their business clients each tax season. With an economy still trying to gain more certain footing, businesses facing new market conditions, and a constantly evolving IRS, the business and tax advisors at KBKG have identified three of the most significant changes the IRS has implemented, each of which can have strong impacts on businesses.

CTP

OCTOBER 2, 2023

Most taxpayers would say they want to take every legally permissible step to lower their tax bill. Yet each year taxpayers fail to claim tax credits they are fully eligible to receive. These credits are often attached to behavior or practices that taxpayers are already engaged in. The missing piece is simply an understanding of what benefits are currently available and how to take advantage of them.

CPA Practice

OCTOBER 2, 2023

By Kelley R. Taylor, Kiplinger Consumer News Service (TNS) If you’re a Kansas City Chiefs fan or a “Swiftie,” you might have wondered recently whether Travis Kelce and Taylor Swift are dating. But all the excitement and talk about Taylor’s appearance at an NFL game has also raised questions about what Eras Tour tickets have to do with taxes. So, to sort out some of the confusion, here’s what you need to know about how reselling concert tickets (not just those for Swift’s tour) might impact your

Accounting Today

OCTOBER 2, 2023

Nearly half the leaders of corporate tax departments believe they're severely under-resourced when it comes to technology and hiring, according to a recent survey.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Insightful Accountant

OCTOBER 2, 2023

You can earn valuable 2024 Top 100 Categorical training points by participating in the upcoming Intuit Virtual Event for ProAdvisors supporting the mid-market with QuickBooks Online-Advanced.

Accounting Today

OCTOBER 2, 2023

Top 100 Firms, wealth managers, PE-backed platform firms and others announced a number of acquisitions and mergers.

Insightful Accountant

OCTOBER 2, 2023

A recent HP global survey found that less than a third think they have a 'healthy' relationship with their job.

CPA Practice

OCTOBER 2, 2023

Venning & Jacques, Inc., one of the most respected accounting and tax firms in Central Massachusetts, recently announced an ownership change and rebranding of the firm as Venning. This strategic move marks a significant milestone in the firm’s growth and evolution, positioning it for even greater success in the future. The firm merged with Agawam, Massachusetts-based accounting firm, Corbin & Tapases on September 27.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Today

OCTOBER 2, 2023

Over 40 technology leaders discussed their recent accomplishments and plans for the future, and nearly all of them involved AI in some form, mostly for insights and workflow automation.

CPA Practice

OCTOBER 2, 2023

Base pay for 11 positions in public accounting is projected to rise 4.9% next year, according to a CPA Practice Advisor analysis of salary data provided by LHH Recruitment Solutions. The global talent solutions provider recently released its 2024 Salary Guide , which includes pay expectations for numerous positions in accounting and finance. According to LHH, there is more optimism heading into 2024 than there was this time last year as 2023 approached.

Accounting Insight

OCTOBER 2, 2023

Modulr , the embedded payments platform, today announces its new integration with Xero , the online accounting software provider, to make supplier payments simple, secure, and automated. Helping accountants and businesses to tackle long-standing frustrations and save time by removing manual processes has long been an important objective for Modulr. Modulr’s partnership with Xero enables accountants and SMEs to automate accounts payable within Xero which completely removes the need to download an

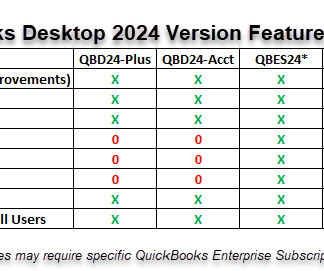

Insightful Accountant

OCTOBER 2, 2023

Intuit has finally released QuickBooks Desktop 2024 by Sept. 20, so now Murph can give you the low-down. His annual Desktop version of QBTalks is tomorrow, Wednesday Oct. 4, 2 pm (EST). Don't miss it.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content