Unpaid payroll taxes Help – Los Angeles, CA local representation firm

MyIRSRelief

AUGUST 1, 2022

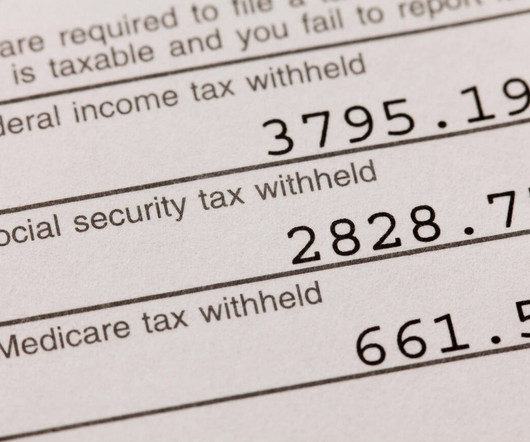

According to the most up-to-date US Tax Code, all US-based business employers are required to file employment 941 / 940 Payroll Tax forms with the IRS every quarter and year-end at a prescribed date. These tax professionals can be your best friend when it comes to dealing directly with the IRS.

Let's personalize your content