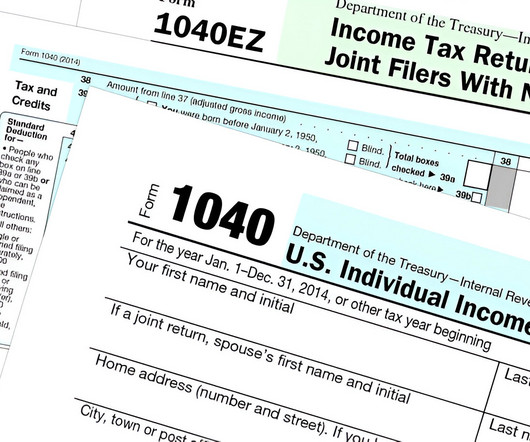

Updates in Proposed Senate Tax Bill Would Impact Not-for-Profit and Other Tax-Exempt Organizations

Withum

JUNE 24, 2025

Expanded Taxes on Exempt Organization Activities and Fringe Benefits The legislation broadens the scope of Unrelated Business Income Tax (“UBIT”) and other taxes, causing certain income and expenses of exempt organizations that were previously untaxed to become subject to taxation.

Let's personalize your content