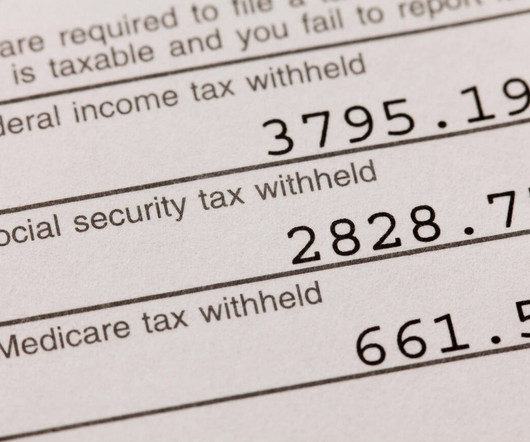

New Washington State Payroll Tax Targets Long-Term Care Expenses

CPA Practice

MARCH 18, 2024

Taylor, Kiplinger Consumer News Service (TNS) There’s another new tax in the state of Washington. The state’s Supreme Court recently upheld a controversial capital gains tax , which has been re-challenged in court and could be on the state’s ballot in November for potential repeal. What is long-term care?

Let's personalize your content