IRS Continues to Issue Guidance for Implementing Clean Energy Tax Credits

Cherry Bekaert

JANUARY 10, 2024

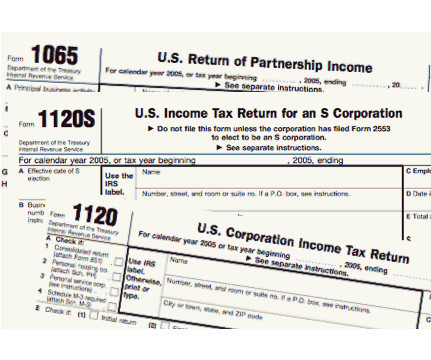

The Internal Revenue Service (IRS) issued proposed regulations for two Inflation Reduction Act (IRA) provisions at the end of 2023. Section 45X is an energy tax credit that operates in a slightly different context than many of the other energy investment and production credits. per kilogram.

Let's personalize your content