Five steps to a seamless payroll year end

Xero

FEBRUARY 15, 2023

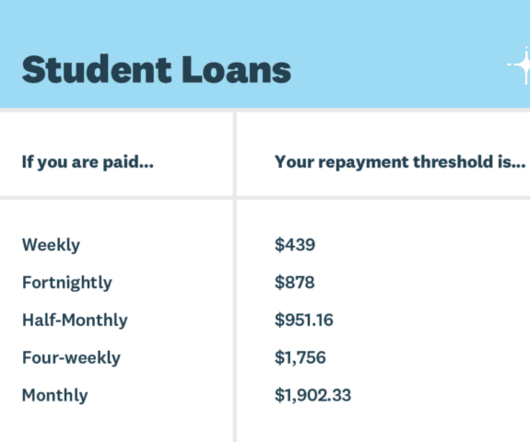

For those working in payroll, that can only mean one thing: year end is approaching. There are four key changes in New Zealand payroll calculations for the new financial year: Adult minimum wage will increase to $22.70 Step one: Post the last pay run Make sure all your pay runs for the financial year have been posted.

Let's personalize your content