IRA fosters small-biz optimism and IRS efficiencies

Accounting Today

AUGUST 30, 2023

A new survey suggests small businesses see the economy — and the tax service — improving.

Accounting Today

AUGUST 30, 2023

A new survey suggests small businesses see the economy — and the tax service — improving.

Going Concern

AUGUST 30, 2023

Another state has pushed to allow prospective CPAs to sit for the exam with just a bachelor’s degree worth of units and that’s good ol’ Texas. Effective September 1, future CPAs can sit for the exam with 120 units of education. Before anyone gets too excited, note candidates still need 150 units for licensure. Rules state the 120 units to sit must consist of no fewer than 24 semester hours of accounting, 21 of which must be upper-level accounting courses including two semester

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 30, 2023

The Internal Revenue Service is telling companies they will need to start electronically filing their forms reporting cash payments over $10,000, starting Jan. 1, 2024.

Airbase

AUGUST 30, 2023

SuiteWorld has massive potential for new connections, growth, and learning. But, it’s also just HUGE. With some research, you don’t have to waste time trying to figure it all out once you arrive. A conference pass isn’t cheap, so you don’t want a lack of planning to keep you from getting the best experience possible. In a digital age, you can’t beat these opportunities to physically connect with relevant vendors and other professionals in your field.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

AUGUST 30, 2023

The Financial Accounting Standards Board voted to require companies to tell the public more about the taxes they pay, starting as early as 2025.

Insightful Accountant

AUGUST 30, 2023

What makes an outstanding Partner Program besides the specific app or software?We're glad you asked.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Xero

AUGUST 30, 2023

The Xero Beautiful Business Fund has officially been open for one week and we’ve received an incredible response so far! We have four funding categories that Xero small business customers can apply to. Whether you’re looking to take the next step in your sustainability journey, seeking to innovate with the latest technological advancements, give back to your community or upskill yourself or your employees, there is a funding category for everyone.

Accounting Today

AUGUST 30, 2023

The Internal Revenue Service issued guidance Wednesday on how taxpayers should report the special tax payments, refunds and rebates they received from states in recent years as a form of relief during the pandemic.

CPA Practice

AUGUST 30, 2023

How to fix the crumbing talent pipeline in the accounting profession is a topic on the minds of many people these days. And it popped up at a session during the first day of the 2023 Unique CPA Conference, “Bridging the Gap,” in the Chicago suburb of Rosemont, IL, on Tuesday. Jackie Cardello During the panel discussion, “Accounting Across Generations: Assessing the Current State of the Industry,” the question, “What do we have to change to rebuild the talent pipeline in the accounting profession

Accounting Today

AUGUST 30, 2023

Strongly governed firms outperform their peers on a wide variety of metrics.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CPA Practice

AUGUST 30, 2023

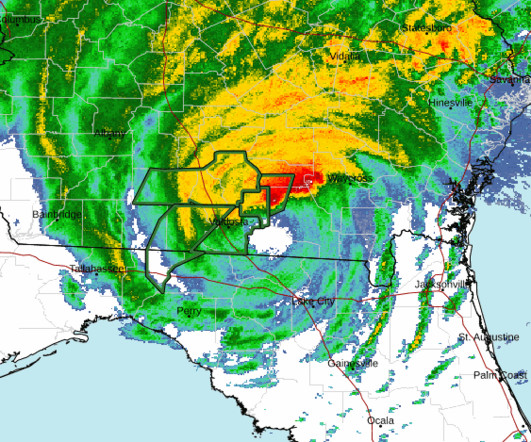

Hurricane Idalia made landfall in Florida early Wednesday morning as a Category 3 hurricane, and with sustained winds of 125 mph or greater. As of noon Eastern time, the hurricane was still a Category 1, and moving over southern Georgia. As a reminder: Even if you have business activities with people or entities in either state, don’t call them today or likely even this week.

Accounting Today

AUGUST 30, 2023

The International Federation of Accountants issued a call to action to the G20 finance leaders urging them to focus more on sustainability as a way to achieve the United Nations' Sustainable Development Goals.

CPA Practice

AUGUST 30, 2023

By Reade Pickert, Bloomberg News (via TNS). U.S. job openings fell in July by more than expected to a more than two-year low, offering fresh evidence that labor demand is cooling. The number of available positions decreased to 8.83 million from 9.17 million in June, the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, or JOLTS, showed Tuesday.

Accounting Today

AUGUST 30, 2023

Whitman Transition Advisors, an advisory organization for accounting firms, made a strategic investment of an undisclosed amount in Tax Titans, a veteran-owned company that operates an online marketplace connecting small businesses and qualified tax professionals.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Ryan Lazanis

AUGUST 30, 2023

Many small accounting firm owners often obsess over automation to operate their business. In this episode, I discussed the key to reducing workload and enhancing firm success. Listen Below. 0:51 – While I was running my own accounting firm, I experienced the allure of technology and automation, and the tempting notion that the right tech solutions could solve all our issues. 1:21 – Numerous firm owners excessively focus on identifying the perfect tech stack, thinking it’s the k

Accounting Today

AUGUST 30, 2023

The Financial Accounting Standards Board released another chapter of its conceptual framework related to the recognition and derecognition of an item in financial statements.

Going Concern

AUGUST 30, 2023

The Treasury Inspector General for Tax Administration released a report Tuesday [ PDF ] they initiated in response to a Congressional request from Sen. Elizabeth Warren (D-Mass.) and Rep. Pramila Jayapal (D-Wash.) to evaluate employees moving between large accounting firms and the IRS, a.k.a the “revolving door”. The Congressional request specifically noted interest in large accounting firms.

Accounting Today

AUGUST 30, 2023

In this week's Vendor Spotlight we discuss payroll, benefits and HR solutions provider Gusto with Will Lopez, Gusto's chief ambassador.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Going Concern

AUGUST 30, 2023

KPMG Canada has surveyed a bunch of Canadian students over the age of 18 about generative AI and found that while many of them are using AI to help with schoolwork, still more think that’s cheating. Unsurprisingly, educators don’t seem to be using AI in the classroom to the extent their students are for their own schoolwork. Here are the key findings: 52 percent of Canadian students are using generative AI to assist them in their schoolwork 60 percent of students who use generative A

Accounting Today

AUGUST 30, 2023

It's not just about "remote" anymore; it's about "international.

xendoo

AUGUST 30, 2023

Getting funding for your startup business is one of the most important decisions you’ll make as a business owner. The type of startup funding you choose will have long-lasting impacts including: How you structure your business and file taxes What percentage of ownership or equity you and your investors get How much profit your business generates and how much you keep What type of bookkeeping and accounting services you need Startup funding can cover the initial costs of setting up and running a

Accounting Today

AUGUST 30, 2023

Annual pay climbed 5.9%, payroll processor ADP reported.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Analytix Finance & Accounting

AUGUST 30, 2023

In the hectic and constantly changing industry of finance, staying ahead of the curve is critical for both professionals and corporations. Several accounting trends are transforming the industrial landscape as we enter the second half of 2023. The coming months forecast dramatic shifts from cutting-edge technologies to a greater emphasis on sustainability.

Accounting Today

AUGUST 30, 2023

Should your firm get on board, or steer clear?

xendoo

AUGUST 30, 2023

Getting funding for your startup business is one of the most important decisions you’ll make as a business owner. The type of startup funding you choose will have long-lasting impacts including: How you structure your business and file taxes What percentage of ownership or equity you and your investors get How much profit your business generates and how much you keep What type of bookkeeping and accounting services you need Startup funding can cover the initial costs of setting up and running a

Withum

AUGUST 30, 2023

Back in 2013, the IRS released the final tangible property regulations, which provided guidance on the application of 162(a) and 263(a) of the Internal Revenue Code. These regulations apply to any corporation, S corporation, partnership, LLC or individual who files a Schedule C, E or F and acquires, produces or improves tangible real or personal property.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Accounting Insight

AUGUST 30, 2023

Today, investment platform Lightyear announces the launch of small business investment accounts for freelancers and sole directors in the UK. This launch comes alongside a brand new partnership with BlackRock to bring access to Money Market Funds for UK businesses without the high fees or minimum investments. New business accounts mean freelancers can invest and earn interest on company money In 2022, the Federation of Small Businesses estimated that the UK was home to 5.5M private sector busine

Summit CPA

AUGUST 30, 2023

Agency owners are always looking for innovative strategies to stand out from the competition. One strategy that every agency owner should consider is productizing services: picking a problem you solve really well, creating a category for it, and then marketing it as-is. Ernesto Tagwerker achieved phenomenal growth by embracing this approach with OmbuLabs, a software boutique that specializes in JavaScript and Ruby.

Accounting Today

AUGUST 30, 2023

Corn farmers and biofuel producers are poised to gain from turning ethanol into sustainable jet fuel — depending on how Washington writes the tax policy.

CPA Practice

AUGUST 30, 2023

By Joseph Wilkinson, New York Daily News (via TNS). The Biden administration wants to give 3.6 million workers access to overtime pay. Under proposed changes from the Department of Labor , any salaried employee making less than $55,000 per year, or $1,059 per week, would be eligible for overtime. That would be a significant jump from the current cutoff at $35,568 per year.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Let's personalize your content