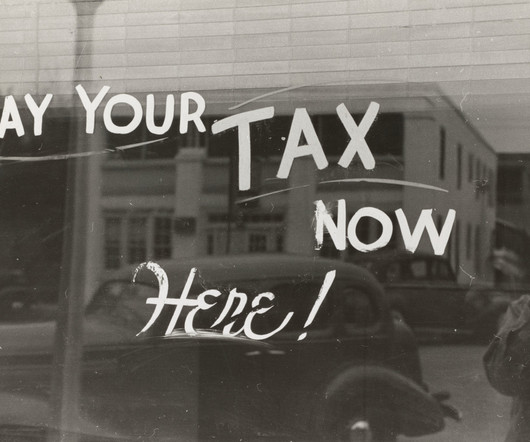

Is Your Income Tax Withholding Adequate?

RogerRossmeisl

SEPTEMBER 19, 2022

When you filed your federal tax return this year, were you surprised to find you owed money? Receiving a tax refund essentially means you’re giving the government an interest-free loan. Adjust if necessary Taxpayers should periodically review their tax situations and adjust withholding, if appropriate.

Let's personalize your content