Hawaii was Best State at Preventing Covid Deaths

CPA Practice

APRIL 3, 2023

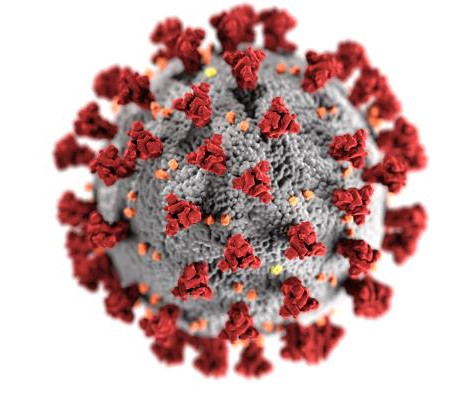

Hawaii was one of the top-performing stats when it came to responding to the COVID-19 pandemic, according to study recently published in The Lancet. On the other hand, Hawaii did not fare so well when it came to employment and economic health, which tanked during the pandemic. Hawaii, under the leadership of former Gov.

Let's personalize your content