4 Accounting Transactions that Use Journal Entries and How to Enter them in QBO

Ronika Khanna CPA,CA

MAY 5, 2024

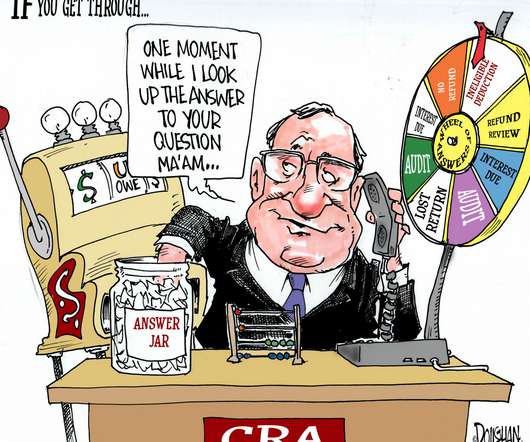

(Expenses can also be entered directly, without a corresponding bill, through the transactions that are downloaded) Bank transactions that are entered directly through the banking section Payroll that is entered through the employee section The transactions listed above have their own separate “ledgers” since these are common transactions.

Let's personalize your content