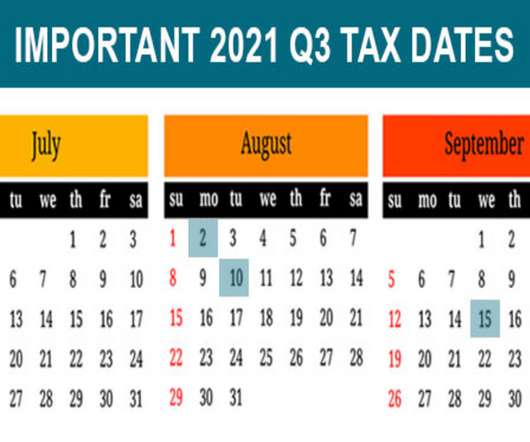

2023 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

RogerRossmeisl

AUGUST 6, 2023

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. July 31 Report income tax withholding and FICA taxes for second quarter 2023 (Form 941) and pay any tax due. See the exception below, under “August 10.”)

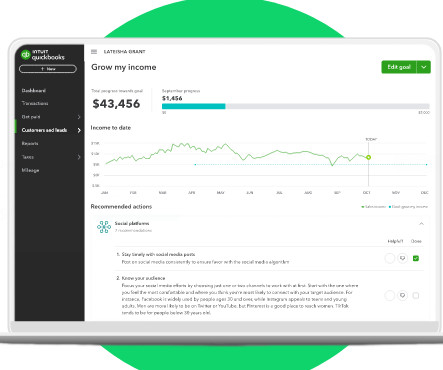

Let's personalize your content