Year-End Tax Strategies for Businesses

Withum

DECEMBER 4, 2024

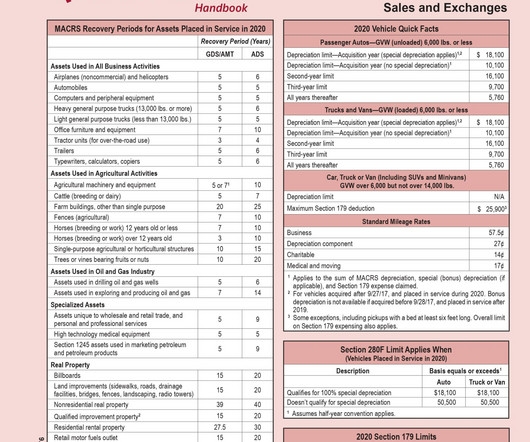

The corporate tax rate is currently a flat 21% rate. There is also a 15% corporate alternative minimum tax (CAMT) based on book income for companies with average annual adjusted financial statement income exceeding $1 billion. Planning should occur with your tax advisor on how to optimize bonus depreciation.

Let's personalize your content