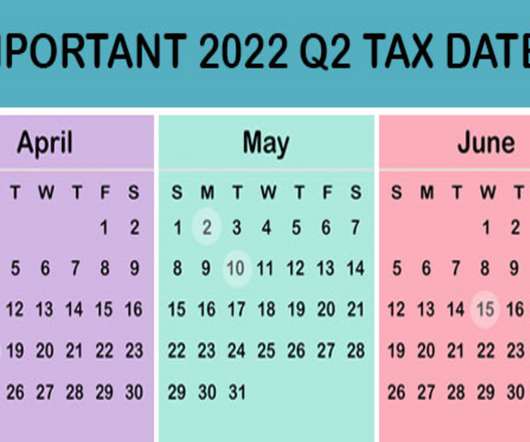

2022 Q2 Tax Calendar: Key Deadlines for Businesses

RogerRossmeisl

APRIL 21, 2022

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. April 18 If you’re a calendar-year corporation, file a 2021 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004) and pay any tax due. See June 15.

Let's personalize your content