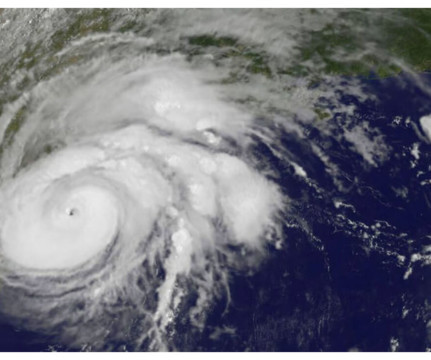

Mississippi, Texas storm victims get tax relief

Accounting Today

JUNE 20, 2025

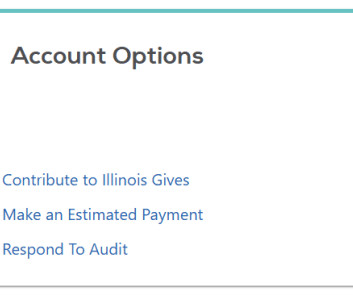

The current list of eligible localities is on the IRS Tax Relief in Disaster Situations page.) 3 deadline for both states applies to individual income tax returns and payments normally due on April 15, 2025. All rights reserved. For individual taxpayers, this means Oct.

Let's personalize your content