One, Big, Beautiful Bill – What Business Owners Should Know About the Latest Proposals

RogerRossmeisl

JUNE 15, 2025

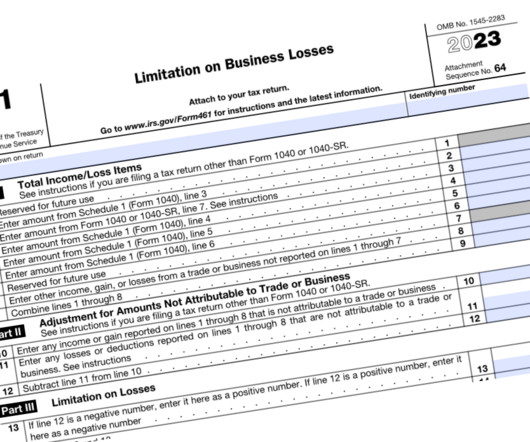

A bill in Congress — dubbed The One, Big, Beautiful Bill — could significantly reshape several federal business tax breaks. Here’s a look at the current rules and proposed changes for five key tax provisions and what they could mean for your business. In 2026, this will drop to 20%, eventually phasing out entirely by 2027.)

Let's personalize your content