How to File Income Tax Return: Tax Filing Preparation Guide 2022

Snyder

JUNE 9, 2022

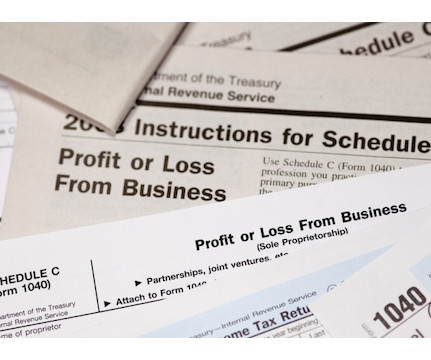

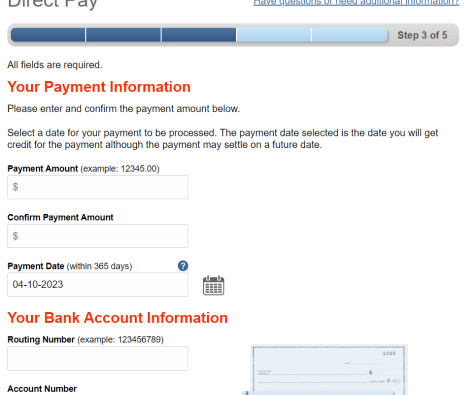

For e-commerce business owners, income tax filing season marks the start of a highly stressful time. Among the taxes that e-commerce businesses need to file, income tax is the most common one. To help you meet the income tax filing season fully armed and prepared, we have compiled a step-by-step guide.

Let's personalize your content