Colorado Businessman Gets 15 Months for $737K Employment Tax Evasion

CPA Practice

JULY 23, 2023

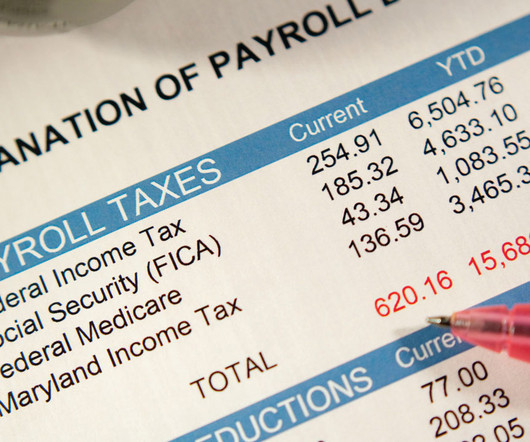

A Colorado man has been sentenced to 15 months in prison for evading the payment of more than $700,000 in employment taxes he owed to the IRS. Starting in approximately 2002 and continuing for many years, Stevens did not pay over the withheld payroll taxes to the IRS or file the required quarterly employment tax returns for his businesses.

Let's personalize your content