Demand for Automation in Sales Tax Compliance is Rising, Avalara Says

CPA Practice

OCTOBER 31, 2024

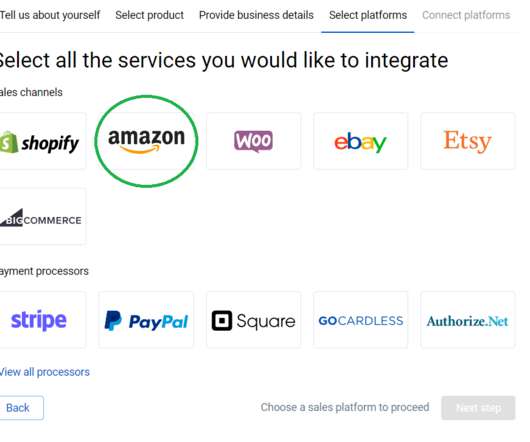

tax professionals responsible for managing sales tax obligations for independent retailers reveals that 97% of respondents say they have automated or plan to automate their sales tax compliance process. Disparate ways of identifying tax changes: Getting and staying informed is crucial for independent retailers to meet tax obligations.

Let's personalize your content