Alaska moves toward statewide sales tax

TaxConnex

MAY 2, 2023

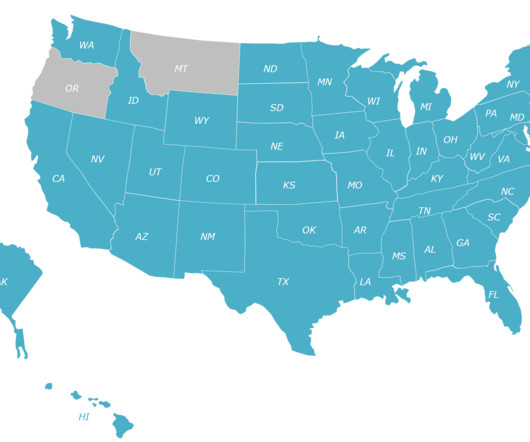

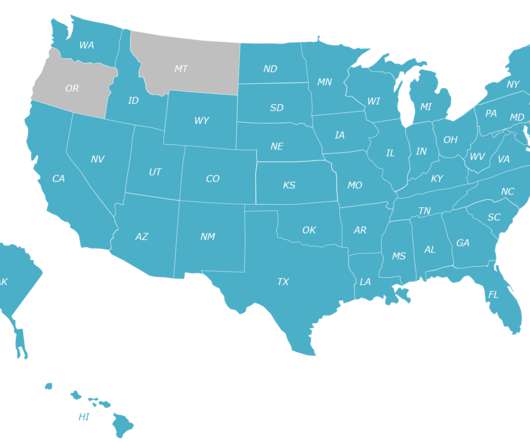

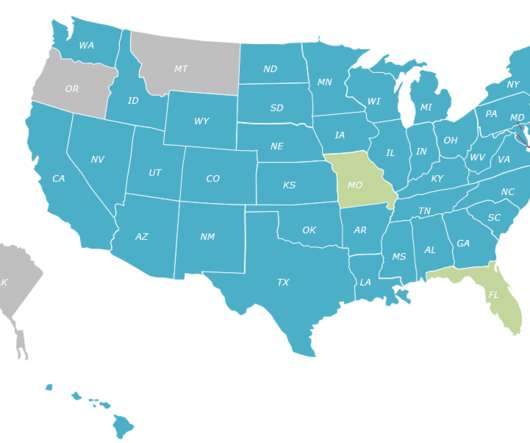

Alaska Gov. Five states don’t have a statewide sales tax: New Hampshire, Oregon, Montana, Alaska and Delaware (aka the “NOMAD” states). Alaska is furthest along of the five in instituting a statewide sale tax. Alaska is furthest along of the five in instituting a statewide sale tax.

Let's personalize your content